Provide a Central Touchpoint to the Bank’s Payment and Transaction Services

Set up a central digital touchpoint where clients can access the bank via a range of channels and devices. Tailor your package to the specific services of your bank and use your own branding, based on the open design. Prepare and customize reports with the in-built report designer and use advanced Data Analytics for tracking user behavior patterns and payment traffic.

Channel and format variety for all customer segments

The solution is constantly updated to comply with the latest technological and regulatory requirements and extended as needed to meet changing expectations. This focus on market needs is also reflected in the wide range of transaction formats and the large number of languages supported.

MultiCash On Produkt-Suite

EBICS or MCFT

Open Banking API

MultiCash On Produkt-Suite

The powerful MultiCash On corporate banking suite provides a rich range of services, accessible by browser or mobile app.

EBICS or MCFT

For corporates asking for a closer integration with their accounting/ERP system, many banks provide a standardized secure file-transfer channel (EBICS or MCFT), options which are widespread in Europe and which Omikron helped to launch and pioneer.

Open Banking API

For users attracted to the services of FinTechs and other Third-Party Providers, a PSD2-compliant Open Banking API based on the Berlin Group standard is integrated in the platform, as well.

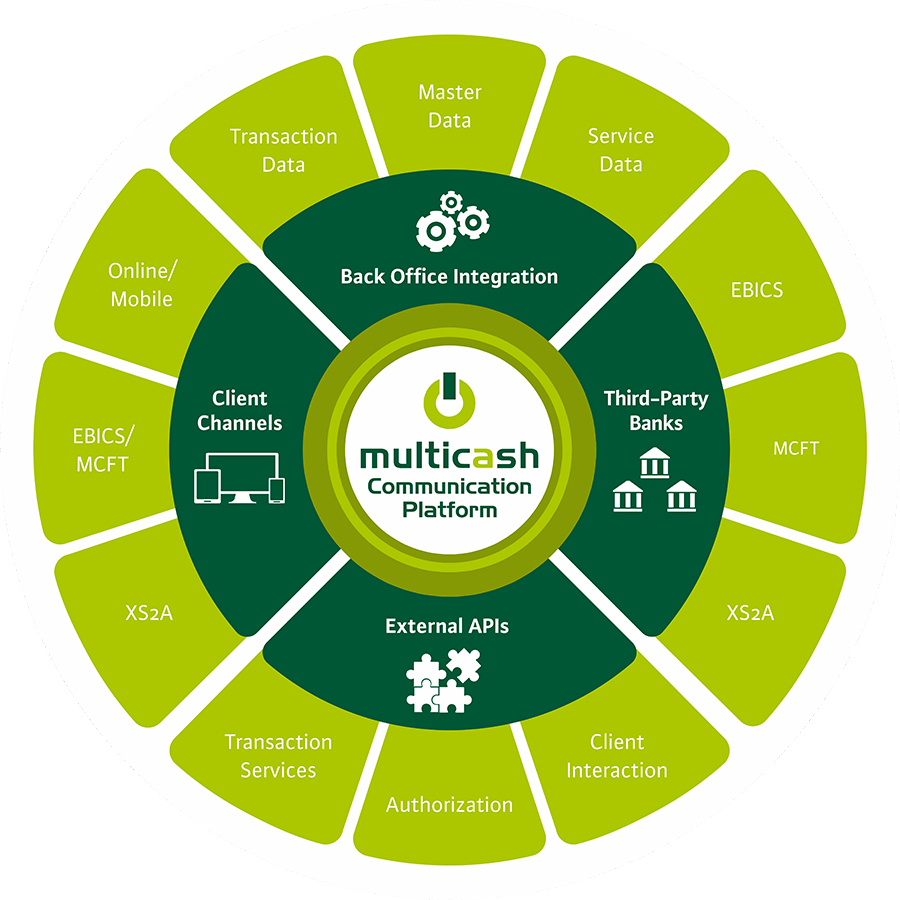

Open Design – Control your Digital Strategy

Secondly, the communication platform has a facility for integrating services from other specialist providers. Examples which immediately add value include external data feeds, such as online exchange rates or maps with branch locator and customer interaction services such as a Chat or Video-Identity function. As the entire set of client functions has been developed as a series of web service APIs, you as a bank are able to integrate all or parts of the functionality within your own portal, in your own look and feel. This supports a “best of breed” approach, when you integrate targeted solutions from leading providers, alongside in-house developments.

Seamless Workflows for Transaction Banking

A Transaction Data Connector allows data of all kinds to be exchanged in real-time with one or more banking systems. Users can in this way easily submit urgent high-value transfers, make Instant Payments, check their financial status or block their credit card – to cite just a few examples. A Service Data Connector supports the exchange of freely configurable information, allowing the bank to define order forms and reports to match the services it can provide. To avoid unnecessary redundancy, a Master Data Connector synchronizes all core data with the core banking system.

Innovation & Experience – A Guarantee for Future-proof Investment

The MultiCash Communication Platform represents the latest generation of Omikron’s established e-banking platform, which is already successfully established worldwide. A major factor behind the success of this solution has been its continuous development, which will continue to be an essential cornerstone of the product strategy in the future. Users who already work with the platform can be sure of a smooth, seamless migration transition to the new version when they update (even if fundamental changes have been made). New users can be confident of investing in a future-oriented system built on robust and proven components and functions. At the same time, the communication platform ensures a smooth and transparent migration from legacy systems, with minimum impact on bank systems and clients. Use of the latest technology ensures optimal data storage and highest performance levels, particularly for large volumes of data which are especially important in corporate business.

Security and compliance in payments

The internal design ensures that users have no access to files or databases at any time, eliminating the risk of misuse or manipulation. Within the application, a granular set of user profiles ensures that each user will access only the options which he/she needs for daily tasks, view and work with only information for which he/she has rights and have no access to data or functions for which he/she is not authorized.