Identifying financial scope and optimizing cash flow

Any ongoing or planned payments can be integrated in these reports. In addition, it includes tools to enable the corporate to set up and manage its own cash pooling, with options for zero and target balancing. A range of reporting options allows the corporate’s current and future financial position to be analyzed in different ways, based on consolidated information on all banks, branches and subsidiaries worldwide. So you can quickly identify any liquidity reserves and make the best use of your cash.

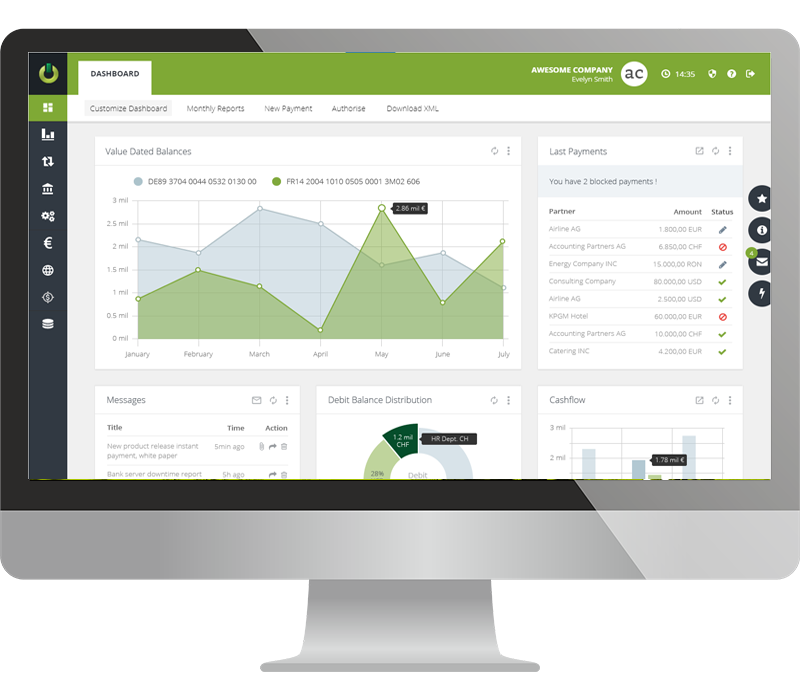

All You need to Manage your Cash

Alongside this set of bank details, you can include your own plan data, by adding details manually and/or by including outgoing transaction flows automatically. Based on this full set of data, the application delivers a cash forecast across all banks and currencies. A wide range of reports and analysis tools, displayed in a transparent tree view, allow you to make the necessary decisions on how to manage your corporate cash.

Liquidity Management Made Easy

At the click of a button, you can create a cross-currency, cross-bank proposal for pooling your corporate cash. Depending on your preferences, you can set this to use zero balancing (cash concentration) or target-balancing. The application automatically proposes transfers which will maximize interest across the accounts. If necessary, you can make adjustments and then a simple approval will ensure that the payments are made immediately. This facilitates the entire financial decision-making process and frees up important resource for other financial activities.

Another powerful tool allows you to plan your incoming and outgoing cashflows directly and decentrally. For easy matching, you can assign transactions to categories which you have defined as needed, e.g. personnel, material. An extensive reconciliation mechanism matches your internal data against transactions reported by the banks, so that differences can be quickly recognized and appropriate actions can be taken.